It’s Time To Seek Financial Advice From Experts.

Your golden years should feel shiny and bright! Taking the right steps early will help you look forward to retirement, and work hard to get there. We believe planning for retirement is more than just savings – it’s about the life you aspire to live. Our Financial Advisors are here to help coach you through this important life stage.

Income Planning

Early Retirement Planning

Saving for Retirement

Employer-Based Plans

Navigating 401(k) Rollover

Social Security Best Practices

Retirement Transitioning

Distribution Planning

What kind of retirement saver are you?

The Procrastinator

You want to save but never do. You want to wait for when the time is right. Which is now! Hiring a financial advisor can help you set a strategy and keep you on track to avoid self-sabotage.

The Early Bird Saver

You might not know the most efficient ways of savings, but you are taking steps early. You might not have a solid strategy but are doing your best to learn. You know what they say: the early bird catches the worm. If knowing is half the battle, the other half is doing. So get started on developing a strategy and game plan for saving. Your consistency will pay off!

The Solid Saver

You might have started a little later but you are keeping up with a savings plan. You know what you want and have your eyes set on something bigger, like a 401k. You are doing great, the way forward will be a smooth journey.

The Late Bloomer

You are at the prime of your career but haven’t prioritized saving yet. You should start getting serious about how much you should be saving for retirement. Figure out how much you can save, set up an automatic payment, and stick with it.

The Super Saver

You are working towards your golden years and making sure you have a comfortable nest egg. You will sacrifice anything to get there. It is important to evaluate your strategy to make sure there’s a balance between your goals and your current lifestyle.

The Messy Over-Saver

You prioritize your savings so much, you can end up falling short on money for expenses. This starts a cycle in which you then have to take money out of savings and/or use credit cards to cover your monthly expenses, which generates debt you then don’t pay off. Focus on a realistic balance between how much you are spending and how much you can save.

A Team Dedicated To Helping You Plan For Retirement

We’re more than financial planners, we’re Life Planners.

Common Tips for Retirement

While every plan is different, below are some common tips from our Advisors.

Retirement Reserve

Portfolio Risk

Does retirement scare you?

Combat your retirement fears with these steps.

Define Retirement

This phase of life means something different to everyone. Dream up what it means to you (traveling the world at age 65+, quitting your job and then watching TV all day, playing bridge, etc.)

Know Your Expenses

To truly know how much income you need in retirement, you need to know how much you’re spending today.

Figure Out Your Hobbies

If boredom is a concern, make sure you start to find your hobbies early, so by the time you retire you understand the things you like to spend time doing.

Start Healthy Mental Habits Now

If you’re concerned about mental decline later in life, you can action that fear starting right now. Focus on mental agility, play sudoku, exercise your brain daily, and form those habits now that will last your lifetime.

Research Adult Classes

Taking education or leisure classes is a great way to remain active during retirement, understanding the options you will have available when the time comes will help you worry a bit less today.

Eliminate The What If Syndrome

Thinking constantly about your retirement worries and future won’t allow you to enjoy the present. Even if it isn’t a fear, it can be baggage that you will carry consistently until you decide to fight it off.

Get In Touch With Old Friends

If you’re worried about your social network or relationships, make sure you are in touch with old friends and family before you reach retirement.

Stay Active Today

Being active today will have a positive impact on your overall health and mind as you get older.

Make A Plan

The best way to combat uncertainty is to make it more certain. Create or update your financial plan to lay out where income will come from in retirement, how much you need to save today, and what goals are realistic for you.

Start Preparing Now

If you haven’t already, the best way to prevent retirement fears (and have more peace of mind) is to start as early as you can.

Essential retirement planning questions

How Much Money Should I Have Saved?

Generic retirement savings targets are helpful, but they don’t actually tell you what you need. Everyone’s situation is unique and ever-changing, which requires a thorough understanding of their specific goals, individual financial habits, and even their behavioral biases. When planning your budget for retirement, make sure to keep in mind your current spending habits, any purchase or travel plans post-retirement, and any healthcare costs that may arise once you’re retired.

Where Do I Get Money Once I’m Retired?

There are three primary sources of income that people may have access to in retirement: personal retirement savings such as Individual Retirement Accounts (IRAs), employer-sponsored defined contribution plans (401(k), 403(b), or a 457(b)), Social Security, or a pension.

How Much Should I Be Saving Each Month For Retirement?

Numerous articles, advisors, and organizations provide suggested savings rates for future retirees. These seek to spell out how much a person should be saving on a monthly basis in order to successfully retire. The most important thing to do when saving for retirement is to develop a strategy that accounts for your personal retirement needs.

Transitioning into Your New Life: Retirement

Whether you want to transition gradually into retirement or dive in quickly, our Financial Advisor teams can support your goals with opportunities and advice that aims to help you live wealthy. We will show you all the options so you can make informed decisions.

Transitioning into Your New Life: Retirement

Whether you want to transition gradually into retirement or dive in quickly, our Financial Advisor teams can support your goals with opportunities and advice that aims to help you live wealthy. We will show you all the options so you can make informed decisions.

Retirement Topics Your Financial Advisor Might Discuss Are:

1

Creating a List of Accomplishments in Retirement

2

Paying Off Debt

3

Creating a Budget & Planning Expenses

4

Considering a Passive or Second Income

5

Knowing Your Risks & Opportunities

6

Consolidating & Simplifying Accounts

Ready to grow your wealth?

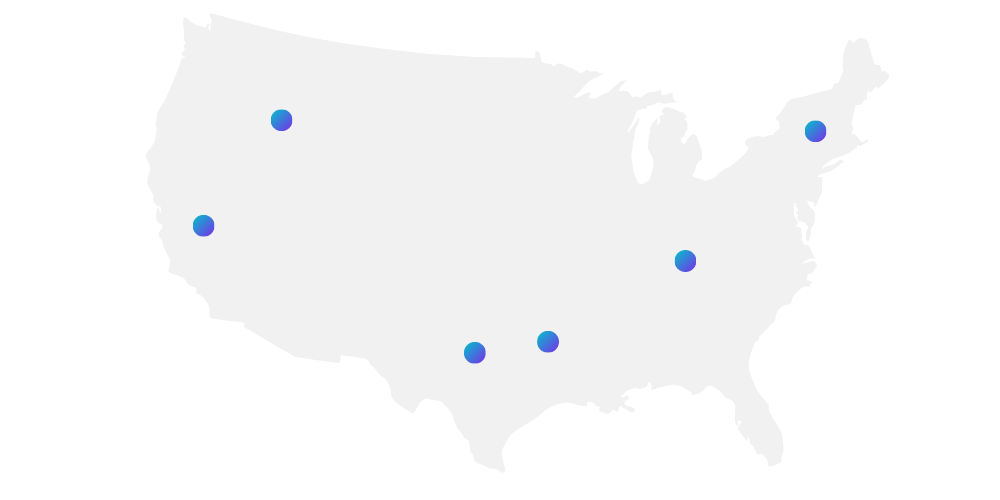

Let us connect you with the most qualified wealth planners

Income Planning for Retirement

Each Life Plan is unique and fueled by a budget to fit your goals.

Each Concierge Financial Advisor is passionate about uncovering all of your options and being your champion to pursue your retirement dreams. Let’s map out your income plan and simplify any complexities so you can feel confident in your future.

Optimizing your

retirement income

Developing a budget & savings plan

Minimizing taxes

Reducing risk &

preserving wealth

Maximizing your Social Security benefits

Selecting a suitable investment approach

Determining your risk appetite

Reducing & eliminating debt

At Concierge, we empower you to live wealthy in retirement.

Collaborate With Your Financial Advisor To Discuss Your Goals

Let’s create a Life Plan that can help you feel most comfortable in retirement.

Real wealth planning should pay off today, and in 10 years’ time.

Concierge Financial’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Concierge Financial does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

© 2022 Concierge Financial | All Rights Reserved | Privacy Policy | Term of Use